Electrification

For a brief moment in 1900, electric taxis made up about a third of vehicles in New York City (another third were powered by steam and the remainder ran on gasoline). But it was gas-powered, internal combustion powertrains that won out. Internal combustion worked because fuel is dense in energy and easy to move and as the technology scaled, costs came down. But we're now entering the final act of the internal combustion engine.

The "peace dividends of the smartphone wars" is a neat way to describe how smartphone innovation has disrupted other sectors through software innovation as well as cheap, low power silicon and sensors (which we'll get to later). But consumer electronics and then smartphone innovation have also served as a pathway along which battery innovation has been catalyzed to create a massive industry of low cost, reliable lithium battery cells with a supporting network of power outlets and an energy grid to support them.

This evolution of batteries has helped birth a new energy innovation battleground centered around electric vehicles. Technology is still helping to improve fuel efficiency and reduce emissions from internal combustion vehicles, but the tailwinds behind electric vehicles - including regulation, infrastructure build-out, consumer mindshare and Elon Musk cat memes - have become very powerful. An electric future is now inevitable.

EVs favor high utilization fleet use cases

As we reach diminishing returns on conventional vehicles and the opportunity for electric vehicles comes to the fore, where does the arbitrage lie in shifting to a new powertrain? The answer to this question is related to utilization.

Internal combustion engines have low upfront costs, but fuel is relatively expensive so costs go up for each mile that is driven. Electric vehicles are the opposite: batteries are expensive, but each additional mile is cheap. This means that the more miles an electric vehicle drives, the more cost-effective it becomes to operate it.

Source: Greenblatt & Saxena; model updated with 2020 and revised 2030 numbers

This tradeoff has significantly improved over time as batteries have become cheaper: according to Bloomberg New Energy Finance battery prices have more than halved since 2013 and are on a steep downward trajectory driven by both investment and policy. Based on current and projected costs of electric and internal combustion vehicles (including upfront costs, maintenance and fuel) the current utilization required to make the average electric vehicle more cost effective is around 25,000 miles per year. That number is on track to decrease dramatically to about 12,000 miles by 2030 (see chart above).

Part of the reason electric vehicles are cheaper at high utilization rates is that they have a third as many components as gasoline powered vehicles. This relative simplicity reduces servicing costs and improves reliability since there are fewer points of failure which further strengthens their value in fleets that are constantly in use.

Source: Goldman Sachs, A disruptive new era of the Automotive Age

Relative simplicity also makes EVs easier to design and manufacture. Complex internal combustion powertrains have served as defensive moats for incumbent carmakers and suppliers.

Source: VW

This comparison of VW's new electric MEB platform (Modularer E-Antriebs-Baukasten) and the legacy internal combustion MQB platform (Modularer Querbaukasten) highlights the relative simplicity of electric powertrains.

As these barriers have come down, a slew of new electric carmakers have followed in Tesla's wake with alluring branding and catchy names like Rivian, Lucid, Arrival and Rimac. China sees an opportunity to ride the next wave of technological innovation and has given significant financial and regulatory support to a new wave of domestic startups with similarly impressive vehicles but somewhat bewildering names like NIO, Li Auto, XPeng, Weltmeister and Byton. These vehicles all have a more fundamentally digital architecture which adds to their appeal and complements the sensor-pervaded, silicon-powered direction in which vehicles are moving. Billions of dollars are being poured into all of these new carmakers and several others besides.

As scale increases and battery costs continue to decline, the value proposition of electric vehicles will only improve, accelerating the flywheel of new investment and adoption. Already the majority of municipal bus sales are electric (given that short, predictable routes make their total cost of ownership significantly lower when electrified) as are passenger vehicles in Norway (helped by generous subsidies and strong incentives). The low energy density of batteries which limits range combined with delays when charging make electric vehicles less fitting for heavy duty commercial use cases, but passenger vehicle and light commercial adoption is expected to explode over the coming years according to BNEF.

Source: Bloomberg New Energy Finance (BNEF)

Given that trips are provided by fleets of vehicles, it is within the trip economy that electric vehicles find a natural home. This is especially true for fleets that own their vehicles and can directly calculate and control the full costs of ownership.

Electrification is a module

Technology is transferable. Just as battery technology developed largely for consumer electronics has accelerated the electrification of cars, so too the electrification of cars can help reinvent the form of other kinds of vehicles. Cars are big because they are decathletes, but vehicles right-sized for particular purposes are in many ways a better fit for electrification.

This right-sizing extends most clearly into micromobility. Electrification works particularly well with small, lightweight vehicles since they require less energy and can be recharged quickly. Since scooters are in some sense large toys, it makes sense that they are powered by the same thing that powers gameboys. Replaceable batteries also make fleet recharging easier.

This rollout is also easier to scale. Electric vehicles can more than double the power draw from a household, creating challenges for the grid especially at the local level where infrastructure has not been designed to support this scale of demand. Fleets of larger vehicles can create even greater strain. The significantly lower charging requirements of micromobility form factors bypass this challenge.

The potential to port core EV technology into new form factors is already starting to play out. 48V electrical systems were developed to improve fuel efficiency and performance of internal combustion vehicles through stop-start motors and turbochargers. Now the same technology is being used by suppliers such as Valeo to power electric rickshaws and motorbikes in India and to create an integrated electric bicycle motor targeted at the European market where electric bicycles are exploding in popularity. Similar trends are democratizing battery cells, packs and battery management software developed for the passenger vehicle market. In this way, electrification is a force that accelerates the trend of unbundling and optimization of vehicles according to the specialized needs of the trip economy.

Hydrogen

Many of the benefits of electric vehicles also apply to hydrogen fuel cell vehicles: a simplified, silent electric drivetrain powered by an energy source that doesn't create pollution in the process of moving the vehicle.

While it is clear that internal combustion engines are losing (and diesel has already lost), it's not yet clear whether fuel cell vehicles can share in the winning. They are still far too expensive. The new Toyota Mirai at $68,100 (or about $58,000 in Europe after subsidies) costs significantly more than comparable non-hydrogen vehicles. Fuel cell vehicles at scale are still a long way off.

Source: Bloomberg New Energy Finance (BNEF)

In contrast, electric vehicles are already price competitive with internal combustion vehicles today (especially when factoring in subsidies) and are rapidly growing their market share, creating a challenge for fuel cell vehicles which are competing with EVs for attention, regulatory support, investment and consumer mindshare.

Besides the higher costs of manufacturing fuel cell vehicles (which lack the kinds of economies of scale of EVs have started to achieve), the current upstream costs of producing hydrogen through electrolysis are still too high to justify most applications. However, there are many viable uses including heating, agriculture and industrial processes such as steel production that create a pathway to scaling demand and justifying investment and regulatory support to bring down energy costs.

Source: McKinsey

Supported by sufficient demand, hydrogen has the potential for long term costs reductions. Hydrogen can be produced in a diversity of ways, helping to support scaling its production into the broader energy value chain. However, the primary focus is on lowering the cost of so-called "green hydrogen" which is produced through electrolysis in a process that does not emit carbon.

Source: The Colors of Hydrogen, Recharge

According to McKinsey, the cost of green hydrogen in Europe (currently around $6/kg) can be reduced by 60% primarily through scaling and improving electrolysis while decreasing the cost of offshore wind energy production. This would bring the cost to about $2.6/kg making it cost competitive for a wide variety of use cases.

Source: Hydrogen Council

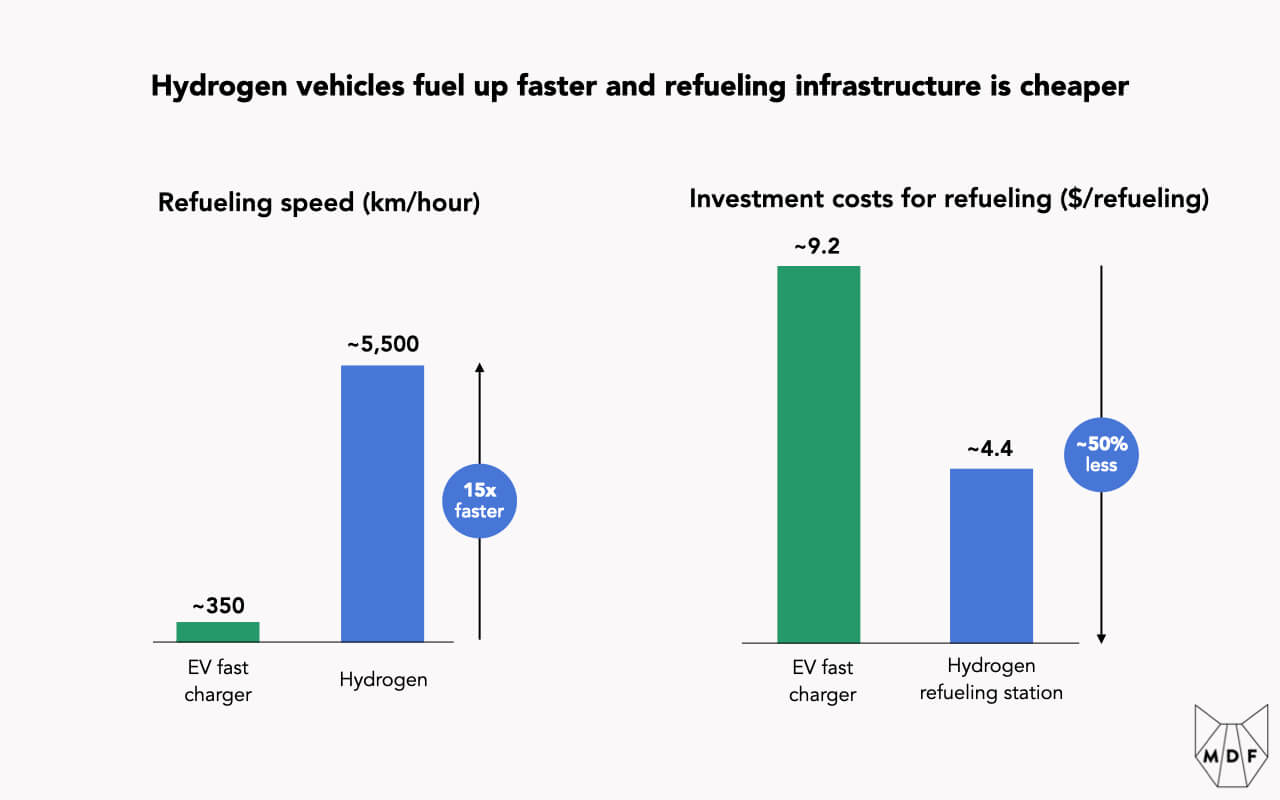

Hydrogen has broad applicability because it is essentially a much denser battery. In transportation, this ties directly to refueling and range. EV batteries are very efficient but they have relatively low energy density and take quite a lot of time to recharge (even with fast charging). This means they work best when vehicles are lighter or cover shorter distances or have significant downtime.

Source: McKinsey

In contrast, hydrogen's massive energy density, about triple that of diesel or gasoline and ten times that of lithium-ion batteries, means shorter refueling times and more uptime. It also gives hydrogen vehicles greater range while adding less weight to the vehicle, meaning they can go further without needing to refuel. This makes fuel cell vehicles most effective in use cases where electric vehicles are weakest such as trucks with heavy payloads or that cover large distances.

In addition, hydrogen's discrete energy economy can help offset the grid-dependent nature of EVs while also bypassing the long tailpipe problem. Electric vehicles require that the grid be able to pick up the energy demand that has thus far been satisfied through fossil fuels, creating strain on particular points in the grid network and a significant increase in overall peak demand.

Source: VW

In contrast, hydrogen is produced and moved independent of the grid (much like fossil fuels). Though hydrogen fuel requires specialized refueling infrastructure, an elaborate system for moving and storing flammable liquid fuels already exists which can be adapted to hydrogen. This combined with higher energy density and much shorter refueling times means that for fleet use cases where range is important, the cost of hydrogen infrastructure is lower than EVs on a marginal basis and is easier to scale since it can be built around the fleet.

So while in the short term, fuel cell vehicles suffer significant challenges achieving scale, in the longer term they have potentially more appealing economics when considering the total cost of ownership since there is more room to create cost efficiencies.

Source: Hydrogen Council

Given strong pressure to achieve climate targets and hydrogen's applicability to complementary use cases to electric vehicles, there is reason to believe that government support, which is already significant in Japan and Europe, will continue to grow giving fuel cell vehicles a viable track to scale alongside EVs, even if right now they still seem stuck in the starting blocks.